At the 56th GST Council meeting, Finance Minister Nirmala Sitharaman unveiled sweeping reforms simplifying the GST structure-from four tiers to just 5% and 18%, with a new 40% slab for luxury and sin goods. Cement, steel, and other construction-related materials have seen their tax rates reduced-marking a transformative moment for the construction and real estate sectors.

What Changed: Key Tax Reductions

- Cement: GST rate cut from 28% to 18%, effective from September 22, 2025.

- Steel products: Included under broader tax relief for “construction products” and transport goods, benefiting from the rate rationalization.

- Other sectors in construction: Granite blocks saw a price-friendly move from 12% to 5%, further easing building costs.

Why It Makes Sense: Impact Answers

- Lower Construction Costs

Cement and steel account for nearly 40–45% of total construction expenses. With the GST cut, developers gain meaningful cost relief, which can translate to better affordability or quicker project timelines. - Stock Market Optimism

Market confidence soared-stocks of Ambuja Cements, ACC, UltraTech, and others rallied, signaling investor belief in stronger demand. - Real Estate Revival

With reduced building costs, especially ahead of the festive season, the consumer sentiment looks positive. This may boost demand in affordable housing segments. - Wider Economic Effect

The rate cuts are expected to temper inflation, revitalize consumption, and simplify GST compliance, all while maintaining fiscal stability.

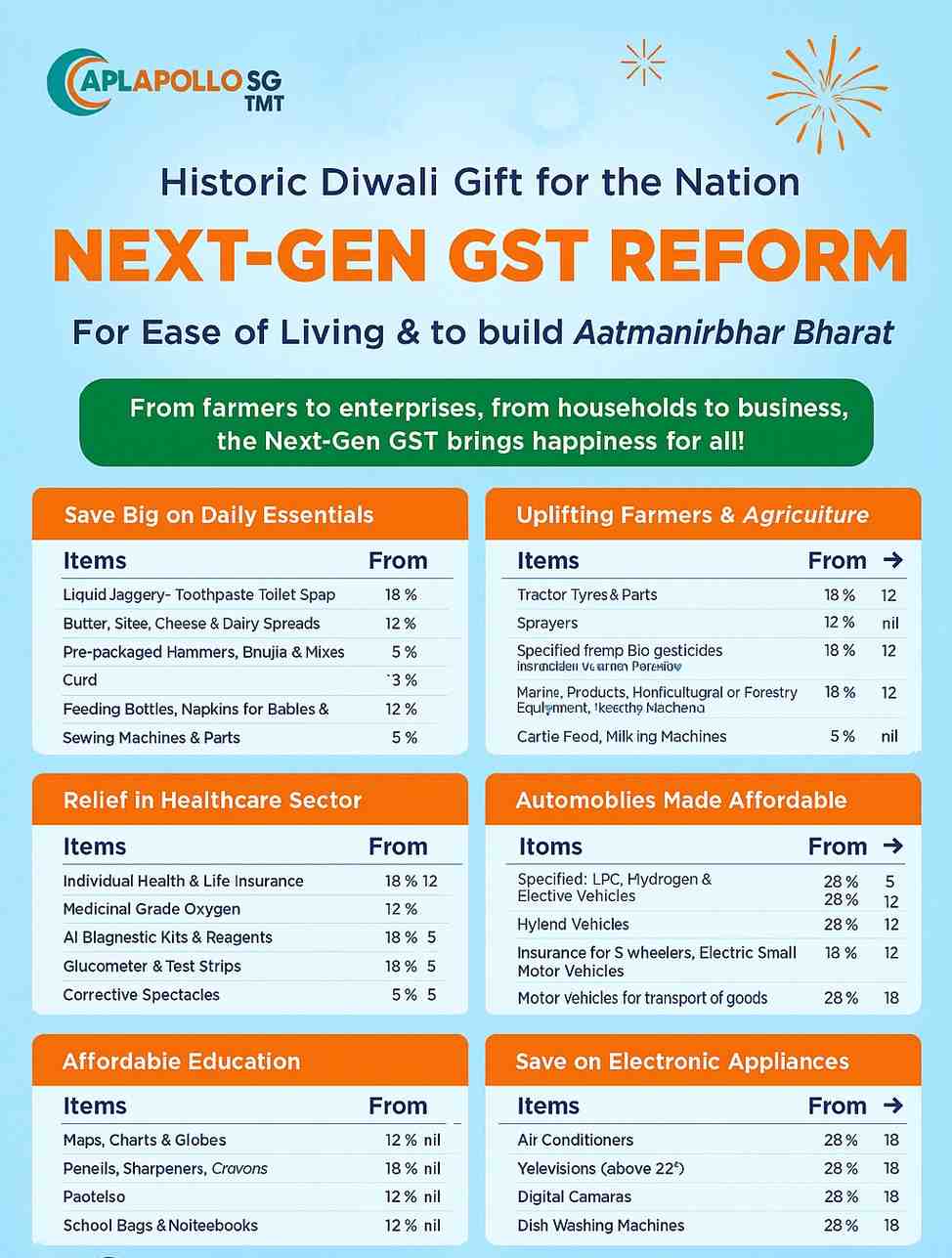

GST Rate List – Chart

What This Means for You

Stakeholder | Expected Benefits |

Contractors | Reduced input costs on materials like cement, steel, granite. Faster execution and better margins. |

Developers | Potential to lower home prices or upgrade project specs affordably. |

Homebuyers | Possibility of more affordable housing options and faster delivery. |

Suppliers | Higher volume of materials may be required; focus on quality and timely delivery will matter more. |

Real-World Example: Affordable Housing Gains

According to industry leaders like CBRE and NAREDCO, reduced GST on cement and steel will likely moderate home prices and enhance project feasibility in affordable housing. For many developers, this translates into faster approvals and more marketable projects.

FAQ: GST Cuts Unwrapped

Q1: When do the new rates take effect?

Starting from September 22, 2025, aligning with Navratri.

Q2: Will prices automatically decrease?

Not necessarily. While input costs fall, developers may choose to retain margin. Market forces and regulatory nudges will likely encourage pass-through to buyers Hindustan Times.

Q3: How much can construction cost drop?

Up to ₹30 per bag of cement, or ₹12 per square foot in urban projects, according to Yes Securities.

Q4: Will steel prices fall?

GST relief on steel helps, but other components like freight and global commodity rates still affect final prices.

Conclusion: A Tax Reform with Broad Reach

The GST 2.0 reforms have delivered a major boost to the construction sector. By slashing taxes on cement, steel, and essential materials, the government has made a strategic move to support infrastructure growth, real estate development, and economic momentum in India.

For contractors, developers, and buyers, the message is clear: the time is right to rethink budgets, accelerate timelines, and seize demand.