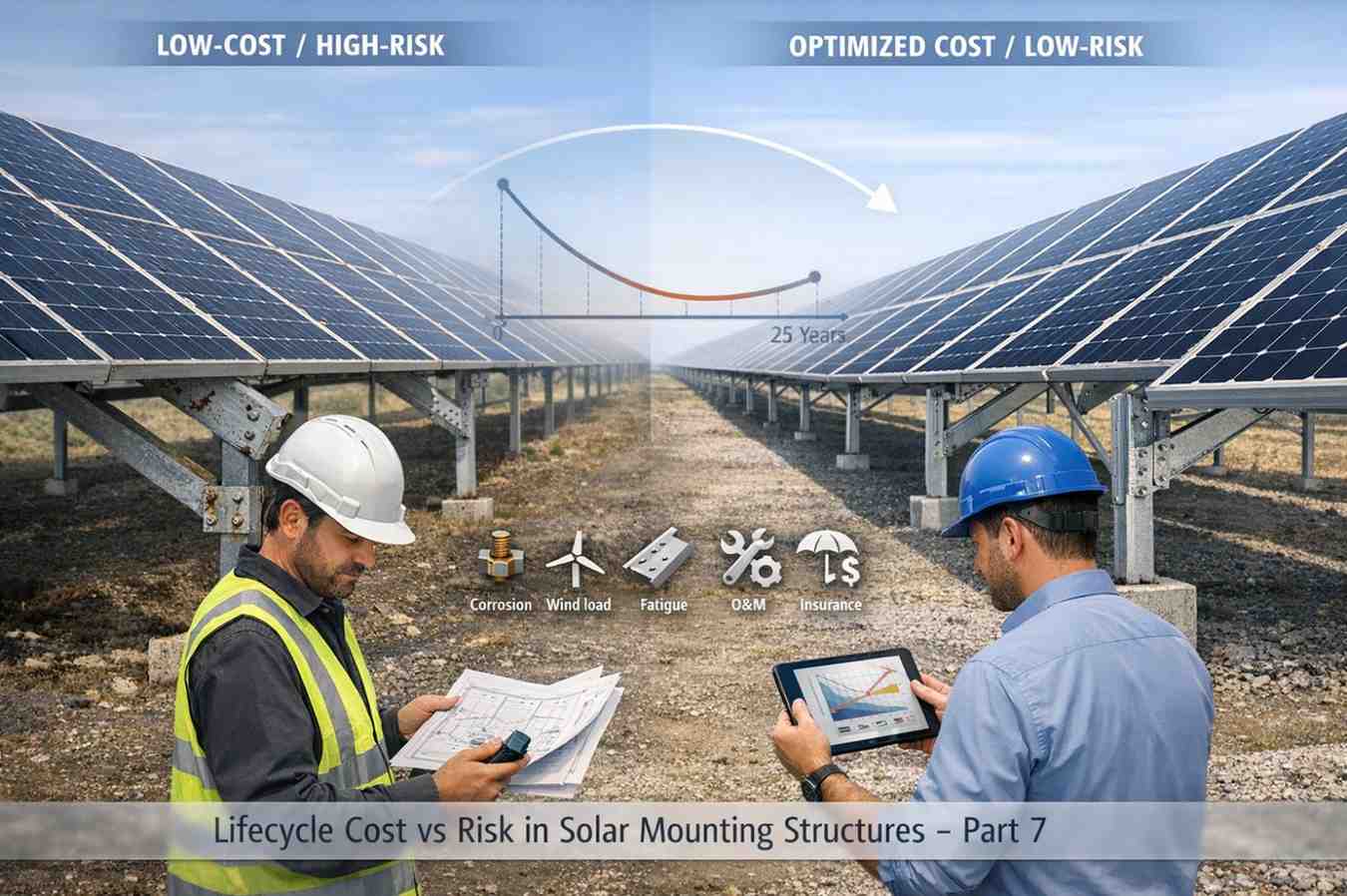

When a solar project is planned, most decisions are made under pressure—tight budgets, aggressive timelines, and competitive tariffs. In this environment, solar mounting structures are often treated as a cost item to be minimized rather than a long-term asset to be optimized. On paper, choosing cheaper steel or a lighter structure may appear to improve project economics. In reality, it often creates hidden risks that compound over the next 25 years.

Lifecycle cost in solar projects is not determined by the initial price of materials alone. It is shaped by how those materials perform under real environmental stress, how they age, how often they need intervention, and how they influence insurance, financing, and operational stability. This is where the gap between “cheapest” and “most economical” becomes dangerously wide.

Understanding Lifecycle Cost Beyond Initial CAPEX

Most project models focus heavily on upfront capital expenditure. While modules, inverters, and land costs receive detailed scrutiny, mounting structures are frequently grouped under a single line item with minimal analysis. This approach ignores a critical reality: solar mounting structures are expected to perform continuously for the entire life of the plant, without replacement.

Lifecycle cost includes far more than the purchase price of steel. It includes maintenance frequency, corrosion protection performance, structural stability during extreme weather events, insurance behavior, and even refinancing outcomes. A structure that looks economical on day one can quietly become the most expensive component of the project over time.

How Structural Risk Accumulates Over Time

Unlike electronic components, structural failures are rarely sudden or isolated. They develop gradually. Small deviations in steel quality, marginal galvanization thickness, or minor design compromises may not cause immediate issues. However, over years of exposure to wind, moisture, heat, and soil conditions, these weaknesses amplify.

Corrosion begins at edges and joints. Bolts loosen due to thermal cycles. Slight misalignments increase stress concentration. Eventually, the structure reaches a point where repair becomes more expensive than prevention ever was. At this stage, developers face forced shutdowns, unplanned reinforcement, or partial replacement—none of which were accounted for in the original cost model.

Read: solar structure design risk

Cheaper Steel and the Illusion of Savings

The most common lifecycle mistake is the assumption that “steel is steel.” In reality, variations in yield strength consistency, chemical composition, and manufacturing quality directly affect long-term performance. Cheaper steel often lacks uniformity, traceability, or proper quality assurance, increasing the probability of deformation, corrosion, or fatigue failure.

Check Steel Quality in Solar Projects

Insurance data increasingly shows that projects built with lower-grade or untraceable steel experience higher claim frequency. These claims may not always be catastrophic, but even repeated minor claims raise red flags for insurers and lenders alike. Over time, this translates into higher premiums, stricter exclusions, and reduced confidence in asset durability.

Corrosion: The Silent Lifecycle Killer

Corrosion is one of the most underestimated risks in solar mounting structures. Many projects meet minimum galvanization standards without considering the specific environmental exposure of the site. Coastal regions, industrial zones, and high-humidity areas accelerate degradation far faster than generic assumptions allow.

Once corrosion sets in, the lifecycle cost curve changes dramatically. Maintenance costs rise. Structural inspections become frequent. In severe cases, insurers classify corrosion-related damage as a foreseeable issue, leading to claim disputes or partial coverage. What initially saved a small percentage in CAPEX can ultimately erode years of operating profit.

Corrosion risk in solar structures

Impact on Insurance and Financing Over Time

Insurance and financing are no longer static, one-time decisions. Solar projects are reassessed periodically for renewals, refinancing, and portfolio expansion. Structures that demonstrate durability, documented maintenance, and stable performance enjoy smoother renewals and stronger insurer confidence.

Conversely, projects with recurring structural issues face higher deductibles, narrower coverage, or even refusal of renewal. Banks and investors closely monitor these signals. A project that becomes “insurance-heavy” is often perceived as higher risk, directly impacting valuation and exit potential.

Explore: how insurance companies assess solar structure risk

Operational Stability and Downtime Costs

Structural issues rarely affect just the structure. They trigger cascading losses—module damage, inverter shutdowns, grid non-compliance, and business interruption. Even temporary downtime reduces generation, impacts PPA commitments, and complicates asset management.

Over a 25-year lifecycle, even small annual disruptions accumulate into significant revenue loss. These indirect costs are rarely included in initial calculations, yet they often outweigh the original savings from choosing cheaper materials.

The Long-Term ROI Perspective

From a lifecycle perspective, the most economical solar mounting structure is not the one with the lowest upfront cost, but the one with the lowest combined risk over time. High-quality steel, robust design, adequate corrosion protection, and disciplined execution reduce uncertainty across the entire operational life of the project.

Also read: how banks evaluate solar project risk

Such structures require fewer interventions, attract favorable insurance terms, and maintain asset confidence among lenders and investors. Over decades, they protect not just physical infrastructure but financial predictability.

Conclusion

In solar projects, cost decisions made at the construction stage echo for decades. Mounting structures, often overlooked in favor of more visible components, play a defining role in determining long-term risk and profitability. Cheaper steel may improve short-term numbers, but it frequently becomes the most expensive decision over a 25-year lifecycle.

TMT bars for infrastructure projects

Developers and EPCs who evaluate structures through a lifecycle lens—rather than a procurement lens—build projects that are not only operationally sound but financially resilient. In an industry increasingly driven by risk management, durability is no longer optional; it is strategic.