When Extending Life Makes Sense—and When Starting Again Is the Smarter Decision

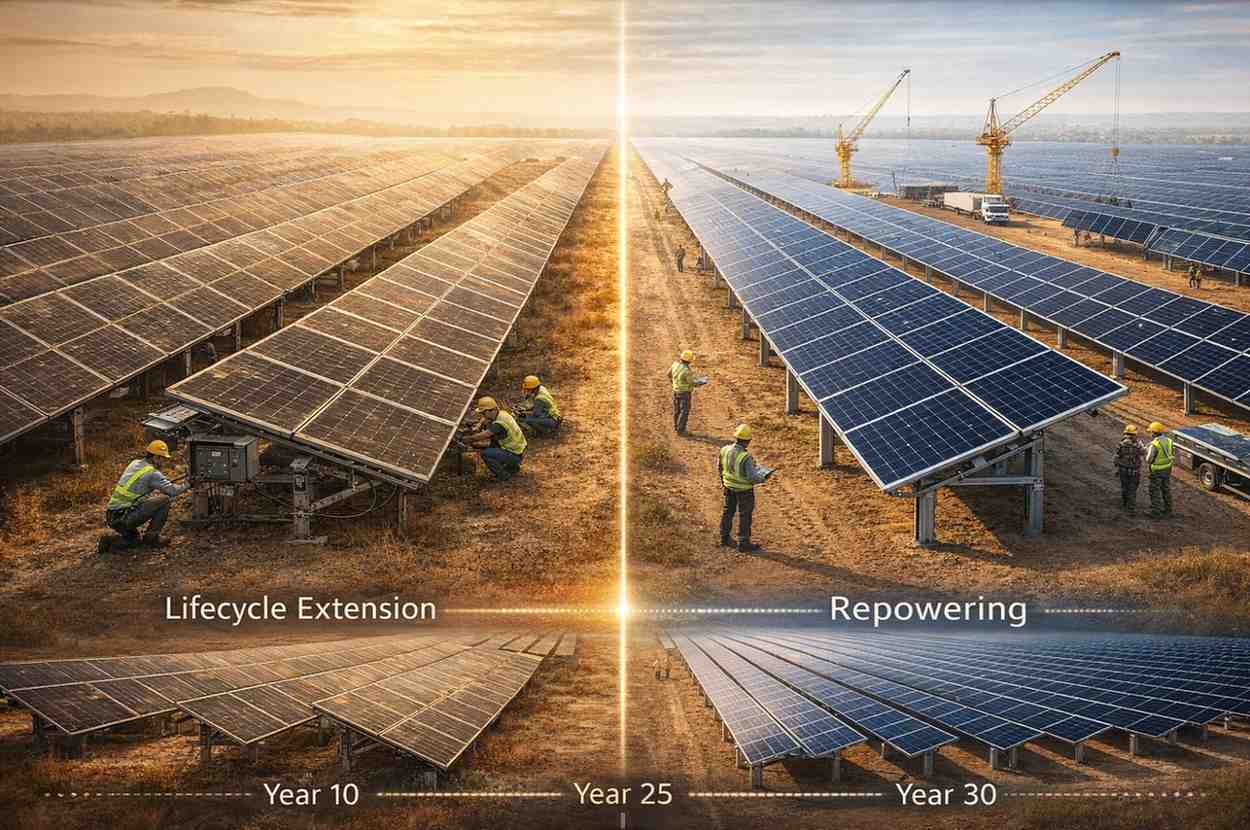

Every solar project eventually reaches a moment of truth. Generation is still happening, but not as smoothly as before. Maintenance costs are rising. Insurance questions are becoming more detailed. Refinancing conversations feel heavier than they used to. Somewhere between year 10 and year 18, asset owners face a critical decision: should the project’s life be extended, or is it time to repower?

This decision is often framed as a technical one, but in reality, it is a strategic and financial choice shaped by how the asset has been treated since day one. Projects don’t arrive at this crossroads equally prepared. Some are well-documented, structurally stable, and economically flexible. Others are already constrained by earlier shortcuts.

Understanding the difference between lifecycle extension and repowering begins with understanding how solar assets age.

Why Most Projects Reach This Decision Earlier Than Planned

Solar plants are designed on paper for 25 years, sometimes more. But design life and economic life are not the same. By mid-life, structures have absorbed years of wind cycles, thermal movement, corrosion exposure, and operational stress. Maintenance decisions taken quietly in earlier years now become visible in balance sheets, insurance clauses, and inspection reports.

Many projects reach the extension-versus-repowering question not because they planned to, but because their operating margin has narrowed. What once looked like a long runway now feels uncertain. This is when asset owners must decide whether to protect what exists or replace it with something new.

What Lifecycle Extension Really Means (And What It Doesn’t)

Lifecycle extension is often misunderstood as simply “keeping the plant running longer.” In practice, it is a structured effort to preserve asset reliability, safety, and insurability beyond the originally comfortable period.

True lifecycle extension depends on structural health. Mounting systems must still carry loads with confidence. Corrosion must be controlled, not patched. Fasteners must maintain integrity. Foundations must remain stable. Most importantly, the history of these conditions must be documented.

When extension works, it is because the project has been maintained with discipline. These plants don’t require heroic interventions; they require validation. Insurers remain engaged. Banks remain open to discussions. Operating costs stay predictable.

Without these conditions, extension becomes expensive guesswork rather than a strategy.

Repowering: Not a Reset Button, but a Reinvention

Repowering is often seen as a clean slate. Replace modules, upgrade technology, increase output, and start fresh. While repowering can unlock value, it is rarely simple.

Structural compatibility becomes the first constraint. Older mounting systems may not support new module dimensions, weights, or load behavior. Foundations designed decades earlier may not align with modern design assumptions. Regulatory approvals, grid agreements, and land-use conditions also re-enter the conversation.

Repowering works best when it is planned, not forced. Projects that treat repowering as a rescue operation often underestimate cost, downtime, and complexity.

How Structure and O&M History Decide the Winner

The deciding factor between extension and repowering is rarely modules alone. It is the condition of the underlying structure and the credibility of its maintenance record.

Projects with strong O&M discipline, corrosion control, and documentation find extension technically feasible and financially attractive. Projects with weak maintenance history face higher risk premiums, insurance hesitation, and uncertainty in load reassessment.

In such cases, repowering may appear logical — not because it is cheaper, but because the existing asset no longer inspires confidence.

At this stage, technical assumptions need to be validated against real structural behavior, not just generation data. Design philosophy, load paths, corrosion protection strategy, and maintenance accessibility all play a decisive role in whether a structure can safely support lifecycle extension or must be reconsidered during repowering. A detailed understanding of how solar mounting systems are engineered and evaluated helps stakeholders make this decision with greater confidence.

The Financial Lens: What Banks and Insurers Actually Look For

When asset owners consider lifecycle decisions, financial stakeholders quietly run their own analysis. Banks examine whether future cash flows are stable enough to justify continued exposure. Insurers assess whether risk behavior has been responsible or reactive.

Lifecycle extension backed by evidence often receives support. Repowering without clarity raises questions. The irony is that financial institutions don’t prefer new assets over old ones — they prefer predictable ones.

Projects that can explain their past usually earn trust for their future.

Why Early Decisions Echo Loudest at This Stage

By the time a project debates extension or repowering, most outcomes are already influenced by earlier choices. Steel quality, coating systems, inspection discipline, and documentation culture all compound over time.

This is why two projects commissioned in the same year can face completely different futures a decade later. One negotiates extension with confidence. The other negotiates exit under pressure.

The difference is rarely luck. It is accumulated discipline.

Choosing the Right Path Without Regret

There is no universal answer to extension versus repowering. The right decision depends on structural condition, operational history, regulatory context, and financial goals. What matters is making the choice deliberately, not reactively.

Lifecycle extension rewards projects that were built and maintained with long-term thinking. Repowering favors those willing to reinvest and redesign. Both paths require honesty about asset condition — and neither benefits from denial.

Conclusion

Lifecycle extension and repowering are not end-of-life decisions. They are maturity tests. They reveal whether a solar project was treated as a short-term installation or a long-term asset.

As the solar industry evolves, success will belong to those who plan not just for commissioning, but for the conversations that happen years later — when structures age, margins tighten, and decisions carry lasting consequences.

Solar projects don’t fail at this stage. They reveal what they have always been becoming.