How Structure, O&M, Insurance, and Finance Quietly Collide in Mid-Life Solar Assets

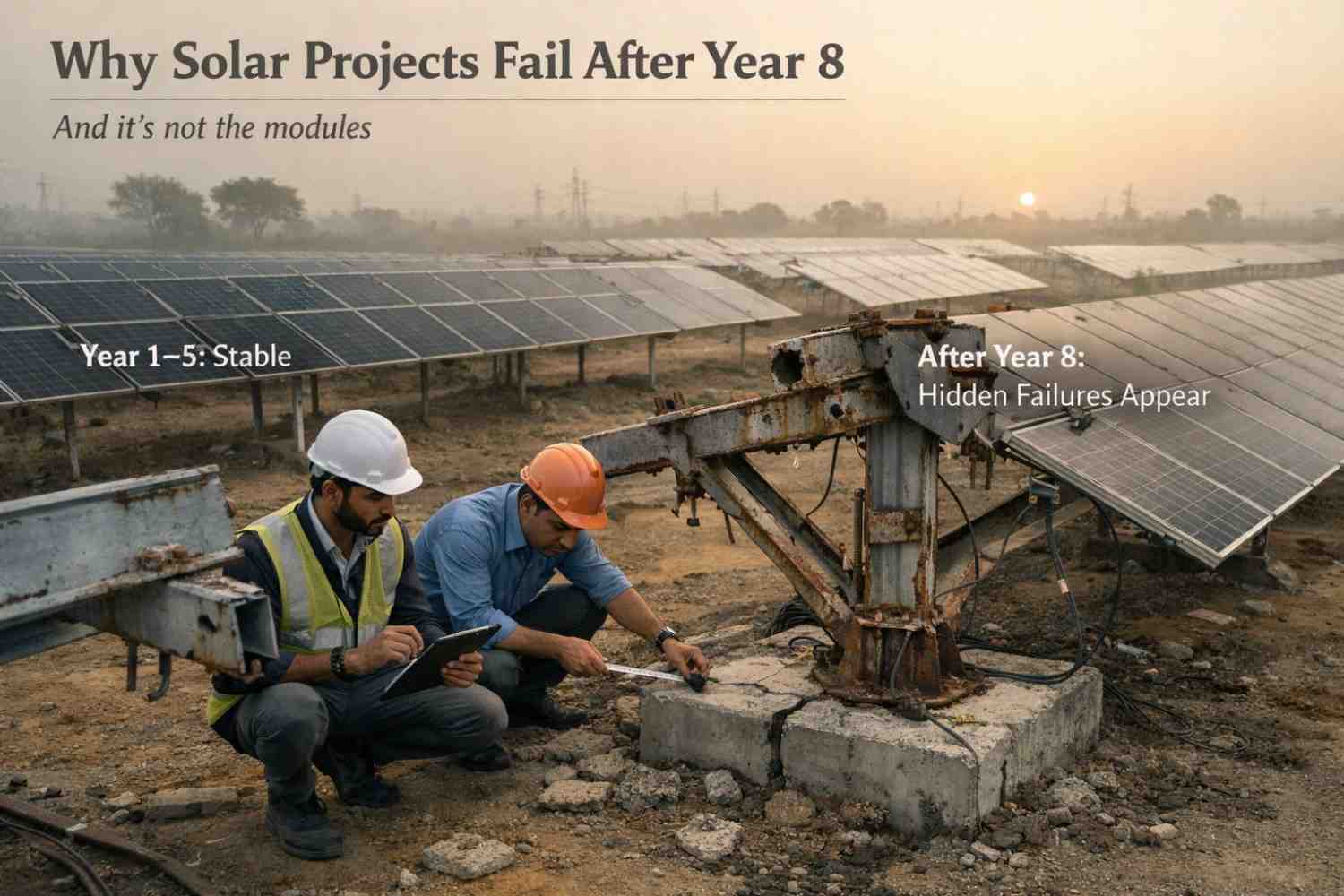

For years, the solar industry has measured success at commissioning. Capacity installed, plant synchronized, generation started — project declared complete. But as India’s solar fleet matures, a new pattern is emerging. An increasing number of projects begin to struggle not in their early years, but somewhere between year 8 and year 15.

What makes this troubling is that these failures are rarely sudden. There is no single storm, no obvious design collapse, no headline-worthy accident. Instead, performance degrades slowly, costs rise quietly, insurance conversations become uncomfortable, and refinancing becomes difficult. By the time asset owners realize something is wrong, the project has already lost strategic flexibility.

This mid-life vulnerability is not driven by modules alone. In most cases, the root cause lies in how structures age, how maintenance is practiced, and how risk is documented — or ignored.

The Myth of “If It Works for 5 Years, It Will Work for 25”

One of the most damaging assumptions in solar project planning is that early survival guarantees long-term stability. If a structure stands through initial monsoons, wind seasons, and thermal cycles, it is often assumed to be safe for decades.

In reality, structural systems behave very differently over time. Fatigue, corrosion, bolt relaxation, and soil-structure interaction are long-cycle phenomena. They don’t announce themselves in year one or two. They accumulate silently and surface when stress thresholds are crossed — often years after warranties expire and EPC accountability ends.

This is why many projects that appear stable in their first phase begin to show problems only when lenders, insurers, or secondary buyers start asking deeper questions.

How Structural Aging Becomes a Financial Problem

As solar assets mature, their value is no longer judged only by generation numbers. Banks and investors begin to assess long-term reliability. Can this plant support refinancing? Can insurance be renewed without exclusions? Is lifecycle extension technically and economically viable?

At this stage, structural health becomes a financial variable.

Minor corrosion that was ignored earlier now raises questions about load capacity. Missing torque records make it difficult to prove that failures were unforeseeable. Undocumented repairs weaken insurance claims. What started as technical neglect slowly converts into financial friction.

Further read:– corrosion behavior in solar mounting systems

Projects don’t fail outright — they become harder to trust.

O&M Gaps Amplify Structural Risk Over Time

Operations and maintenance failures rarely destroy assets on their own. Their real danger lies in amplification. A loose connection increases vibration. Vibration accelerates fatigue. Fatigue weakens joints. Weak joints affect alignment. Misalignment impacts modules and electrical systems.

Each step seems manageable in isolation. Together, they reshape the risk profile of the entire plant.

By mid-life, O&M that was reactive instead of preventive leaves behind a trail of small compromises. These compromises are difficult to reverse without significant cost — and often without shutting down parts of the plant.

Why Insurance Becomes Stricter as Projects Age

Insurers have started reading solar projects differently than they did a decade ago. Early-life coverage focuses on extreme events. Mid-life coverage focuses on behavior.

Was maintenance documented?

Were inspections consistent?

Were early signs of degradation addressed or ignored?

As projects age, insurers increasingly link claims to maintenance discipline rather than force majeure. Plants with weak O&M records find themselves facing exclusions, higher deductibles, or disputed claims — not because damage occurred, but because risk management could not be demonstrated.

Insurance, once taken for granted, becomes conditional.

The Quiet Impact on Refinancing and Asset Transfers

Many solar developers plan exits or refinancing once projects stabilize. But mid-life instability complicates these plans. Due diligence teams now examine structural drawings, corrosion protection strategies, and O&M logs with the same seriousness as generation data.

A project that looks strong on paper but weak in documentation often suffers valuation pressure. Buyers price in uncertainty. Lenders demand additional safeguards. What could have been a smooth financial transition turns into renegotiation.

Also Read:- How Banks Assess Aging Solar Assets

In this phase, the cost of earlier shortcuts becomes visible — not as repair bills, but as lost opportunity.

Why Long-Life Solar Assets Are Built in Operations, Not Construction

The strongest solar assets are not those built with the lowest capex, nor those commissioned the fastest. They are the ones that treat operations as a continuation of engineering, not an afterthought.

These projects monitor structures, not just output. They invest in documentation, not just repairs. They see maintenance as lifecycle insurance rather than cost.

Over 20–25 years, this mindset creates a compounding advantage. Structural integrity is preserved, insurance relationships remain stable, and financial flexibility is retained.

Conclusion

The rising number of mid-life solar project failures is not a mystery. It is the predictable outcome of treating long-term assets with short-term discipline.

Solar plants don’t suddenly become risky after year 8. They reveal the consequences of earlier decisions — in design assumptions, material choices, maintenance culture, and documentation habits.

As the industry matures, success will increasingly belong to projects that understand one simple truth: solar assets are not judged by how they begin, but by how they age.